As we look toward 2026, the startup talent market has stabilized. The "growth at all costs" era is over; the "efficient growth" era is here.

This guide provides projected salary bands for Pre-Seed to Series B companies. Note that these ranges assume a standard "Startup Equity Package." Companies offering lower equity must compensate with higher cash-based salaries (typically 10-15% higher).

Data Sources: Aggregated placement data from major US Tech Hubs (Atlanta, NYC, Austin, SF).

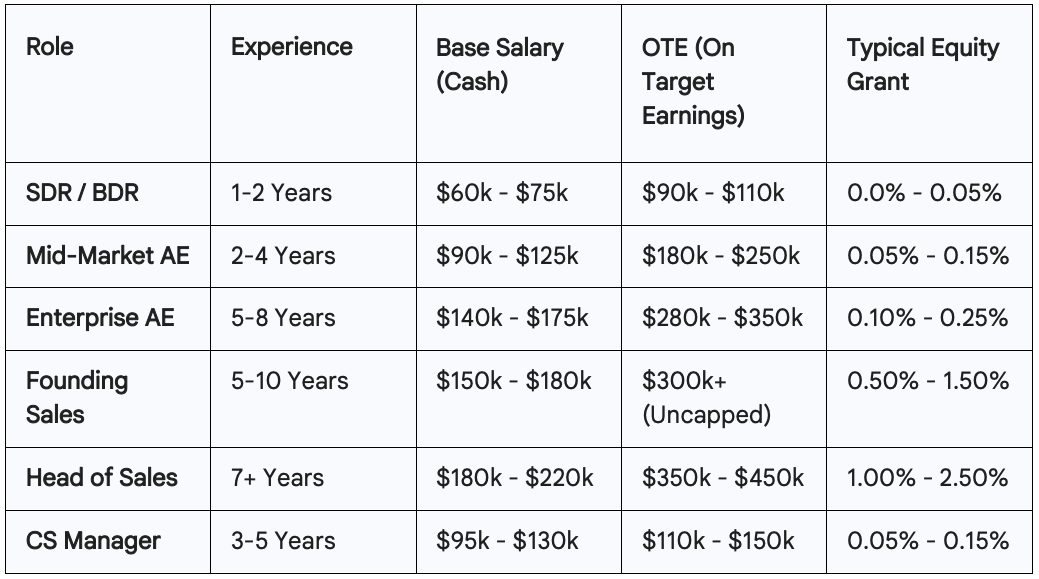

The engine of your company. In 2026, we see a rise in "Full-Cycle" roles over specialized SDR/AE splits at the early stage.

2026 Trend: "Founding Sales" roles are commanding higher equity stakes as founders look to preserve cash runway in the early days.

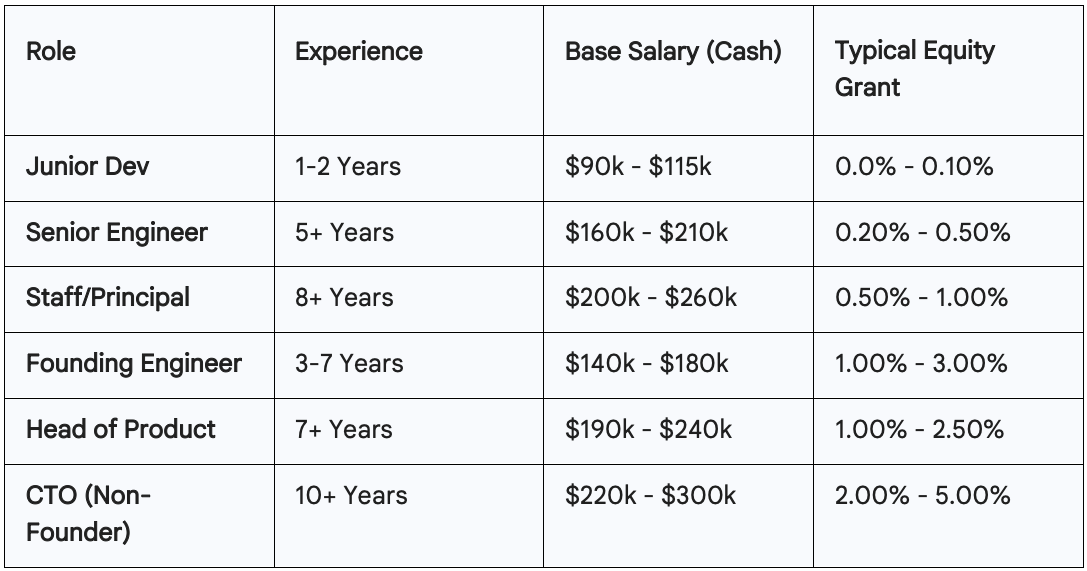

Technical talent remains the most expensive line item. 2026 projections show a flattening of junior salaries but a premium on "Senior Individual Contributors" who can ship end-to-end.

The "AI Premium": Engineers with proven production-level AI/LLM experience are currently commanding a 15-20% premium on top of these base numbers.

One of the most common questions we get is: "How much cash can I save if I offer more stock?"

While every candidate is different, here is the general 2026 rule of thumb for negotiation leverage:

Warning: This only works if you effectively sell the vision and exit potential of the company. Equity in a company with no clear vision is worth $0 to a candidate.

Disclaimer: These figures are market averages intended for budgeting purposes. For a custom compensation analysis based on your specific funding round and tech stack, contact your Buckhead Recruiting Account Executive.